In the rapidly evolving landscape of finance, businesses are increasingly turning to blockchain payments as a transformative solution. Harnessing the power of different aspects of blockchain technology offers businesses unique efficiency, transparency, and security in their financial transactions. As businesses seek innovative ways to simplify financial processes and enhance security, the insights provided here explain the great impact blockchains and payments through them can have on the future of corporate transactions. This article delves into the key components that make payments through blockchains a game-changer for businesses, all whilst exploring related benefits and successful use cases.

Blockchain payments modernize business transactions using a secure and decentralized technology. Instead of relying on a central authority, a network of computers validates and records transactions in a tamper-proof ledger. This transparent and efficient system enhances trust and reduces the risk of fraud. By eliminating intermediaries, blockchain payments empower businesses with faster, more secure, and cost-effective financial transactions, marking a pivotal shift in modern payment methods for streamlined corporate operations.

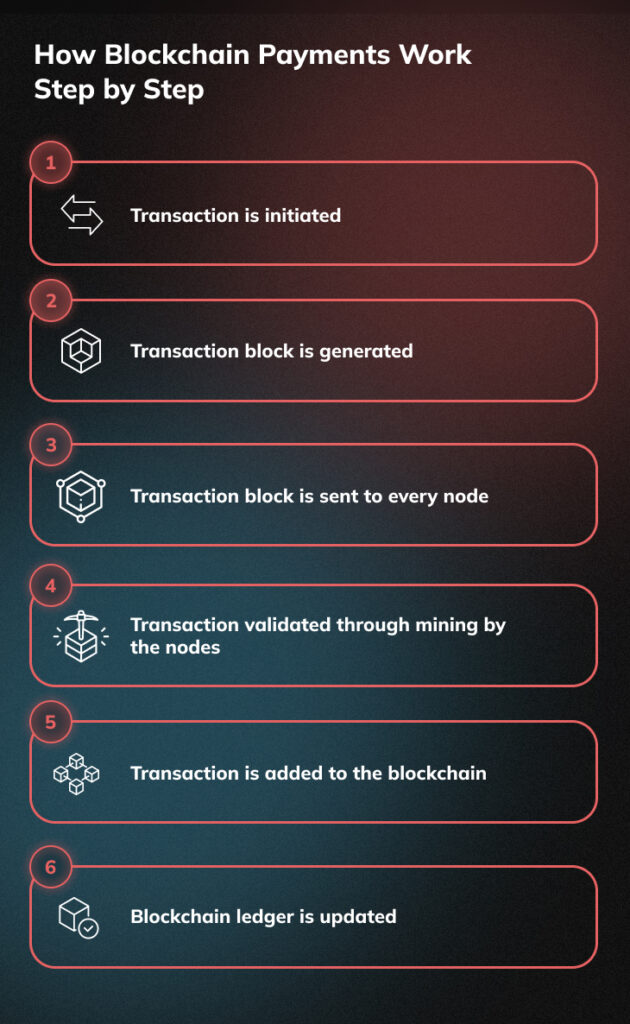

Payments through a blockchain, at first look, are a straightforward process. It begins with the initiation of a transaction, which is then broadcasted to the blockchain network for validation by participant computers called nodes. Nodes verify the transaction for accuracy, checking the sender’s funds and compliance with the network’s rules. Upon verification, the transaction becomes a block, securely linked to the previous one. Confirmation is done through either Proof of Work or Proof of Stake verification methods, and the block is permanently added to the blockchain. The digital ledger and wallets of both sender and recipient are then updated to show the completed transaction.

The blockchain technology, conceptualized by an individual or group using the pseudonym Satoshi Nakamoto, was created to provide a decentralized, secure, and transparent system for peer-to-peer transactions, eliminating the need for intermediaries and enhancing trust in digital interactions. A blockchain is a decentralized digital ledger, meaning that it has no central control, and is instead transparent and available to all participants. It consists of blocks, each containing a list of transactions, and is linked together in a chain. Every block contains a cryptographic reference to the previous one, creating an unalterable system.

Cryptography is essential in blockchains, utilizing hashing and public-private key encryption for secure transactions. Hashing involves the conversion of transactional data into a fixed-length alphanumeric sequence, ensuring data integrity. Public-private key encryption uses pairs of keys: the public key, visible to all, and the private key, known only to the owner. The public key encrypts data, and only the corresponding private key can decrypt it, ensuring secure, verifiable transactions. This cryptographic foundation provides a strong structure for data protection, authentication, and trust in blockchain networks, safeguarding the integrity and confidentiality of digital transactions.

Consensus mechanisms in blockchains set in place how transactions are validated, ensuring agreement among network nodes. The Proof of Work (PoW) verification method involves nodes solving complex mathematical puzzles to validate transactions, demanding computing effort and energy. The Proof of Stake (PoS) method, on the other hand, relies on participants’ stake or ownership of cryptocurrency, granting them the right to validate transactions. These mechanisms maintain the integrity of decentralized ledgers by preventing double-spending and establishing a trustful, agreed-upon transaction history. Other variations, such as Delegated Proof of Stake (DPoS) and Practical Byzantine Fault Tolerance (PBFT), offer alternatives, each balancing security, efficiency, and decentralization in unique ways.

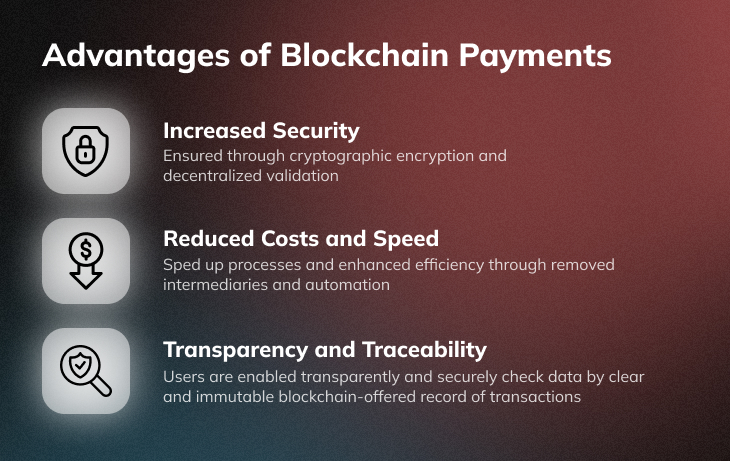

Blockchain payments offer distinct advantages over traditional payment methods, revolutionizing financial transactions. The decentralized nature of blockchain enhances security and eliminates the need for intermediaries, ensuring transparent and tamper-resistant records. Additionally, the efficiency and speed of blockchain payments surpass traditional methods, empowering users with greater control over their financial interactions.

These advantages bring an innovative approach to payments, which marks an ideal change in the way businesses and individuals engage in transactions, introducing a more reliable, secure, and efficient means of conducting financial affairs. The following advantages are what bind all this together.

By using decentralized ledgers, your business can benefit from transactions safeguarded from tampering and unauthorized access. The decentralized structure of blockchain eliminates single points of failure, lowering vulnerability to cyber threats. Network nodes validate each transaction, fostering trust and preventing the dependance on intermediaries subject to security breaches. Smart contracts automate processes, diminishing the likelihood of human error. Through blockchain adoption, businesses ensure the security of their financial transactions, creating resistance against fraud. They also preserve the integrity of payment processes in our progressively digital and interconnected business environment.

For businesses, blockchain payments translate into cost efficiencies and rapid transactions. Blockchains minimize transaction fees and administrative expenses, leading to substantial cost savings. The decentralized and automated nature of blockchain payments accelerates transaction speed, overcoming the delays inherent in traditional banking systems. Embracing blockchain not only enhances operational efficiency but also positions businesses at the lead of a secure, swift, and cost-effective financial landscape, where each transaction becomes a seamless and value-adding element of their operations.

The transparent and traceable system of blockchain provides payment companies with several advantages. Firstly, it creates trust among stakeholders by ensuring an immutable and publicly or privately accessible record of transactions. This transparency enhances accountability, crucial for regulatory compliance and building a positive corporate reputation. Additionally, the traceability feature helps in fraud prevention, simplifies auditing processes and allows for precise fund tracking. These benefits collectively contribute to operational efficiency, reduced risks, and increased confidence in financial dealings.

Blockchain payments offer transformative benefits for businesses innovation, efficiency, and a competitive edge in the digital era. Supply chain management benefits from blockchain’s ability to provide an unalterable record of every transaction, ensuring authenticity and transparency. The technology also enables efficient data sharing across business networks, enhancing collaboration while maintaining data integrity.

Your business can be positioned at the forefront of technological innovation by embracing blockchain technology, allowing it to adapt to changing market dynamics. As consumer expectations evolve, businesses leveraging blockchain not only enhance operational efficiency and security but also future proof themselves in an increasingly digital and competitive business landscape. Let’s look into the four main advantages of blockchain payments for your business.

Businesses can tap into a profitable market by accepting crypto payments for NFT (non-fungible token) sales. Embracing digital currencies like Bitcoin or Ethereum the customer base to include a tech-savvy audience familiar with digital currencies. Embracing cryptocurrencies like Bitcoin or Ethereum enables quicker and borderless transactions, reducing processing times and fees associated with traditional payment methods. Your business can tap into this world easily through the following three attributes.

Cryptocurrency wallets are digital tools that store and manage digital assets, enabling businesses to send, receive, and secure cryptocurrencies like Bitcoin. Setting up a wallet is essential for businesses entering the crypto space, providing a secure means to handle transactions, attract a broader customer base, and capitalize on the growing market for cryptocurrency sales.

Payment processor integration in online sales platforms allows businesses to seamlessly accept cryptocurrencies and convert them into local fiat currencies (like USD, EUR or GBP). This invites a broader customer base to the business’ catalogue, it rationalizes transactions and facilitates compliance with traditional financial systems. Overall, this provides businesses with a versatile and efficient means of conducting cryptocurrency sales.

Choosing the right blockchain is crucial for businesses entering cryptocurrency sales. Ethereum, with its smart contract capabilities, is widely adopted and versatile. Binance offers high transaction output and low fees, ideal for high-volume trading. Flow focuses on scalability and user-friendly experiences, while Tezos emphasizes self-amendment and smart contract flexibility. Choosing the blockchain aligning with specific business needs ensures efficient transactions, reduced costs, and optimal functionality in the rapidly evolving crypto market, providing businesses with a competitive edge and a solid foundation for successful cryptocurrency sales.

Businesses embracing blockchain payments experience a significant reduction in transaction costs associated with traditional payment systems. This cost-effectiveness is particularly beneficial for high-volume transactions, optimizing operational budgets and increasing overall profitability. Embracing blockchain not only ensures secure and transparent transactions but also positions businesses to operate more efficiently, redirecting saved costs toward innovation and growth in a challenging field, where it’s important to stand out from competitors.

Costs for businesses leveraging blockchains for transactions can significantly be reduced by the removal of intermediaries, such as banks or payment services. The decentralized nature of blockchains eliminates the need for third-party involvement, reducing associated fees. This direct peer-to-peer interaction not only decreases transaction costs but also accelerates the speed of financial operations. By avoiding traditional intermediaries, businesses gain better control over their transactions, fostering efficiency and cost-effectiveness, ultimately contributing to a more agile and competitive business strategy.

Blockchains empower businesses to facilitate seamless cross-border transactions, especially in the realm of NFT sales. By leveraging blockchain technology, businesses can enable international customers to purchase NFTs without the problem that hefty fees seem to be, especially associated with traditional cross-border transactions. Blockchains are offering businesses an opportunity to tap into a global market for NFTs while providing a frictionless experience for international buyers. This enables businesses to reach a global audience, breaking barriers and expanding their customer base through decentralized transactions.

Blockchain-based business payments benefit from streamlined transactions through increased efficiency and reduced operational complexities. This streamlining reduces delays, minimizes administrative burdens, and enhances overall transaction speed, contributing to a secure and trustworthy payment environment. Companies leveraging streamlined blockchain transactions experience improved operational efficiency, lower costs and faster processing times, making blockchain a transformative technology for advancing the effectiveness and reliability of business payments.

Smart contracts, a key program of blockchain technology, automate business processes seamlessly. They are self-executing contracts with coded terms that, when met, trigger automatic actions. In the blockchain payments field, smart contracts revolutionize tasks like payment confirmation, transfer of ownership, and royalties’ distribution. By removing manual intervention, these contracts ensure accuracy, reduce delays, and eliminate the need for intermediaries. This not only streamlines operations but also enhances trust, efficiency, and cost-effectiveness for businesses and their clients.

Through smart contracts and the decentralized nature of blockchains, your business can benefit from direct payments without the need of middlemen or third-party companies. This will reduce any additional transaction fees, which benefits both parties. Additionally, with the help of smart contracts, the process is automated, which reduces transaction times and efforts for both your business and your clients.

Blockchains have a versatile list of business operations which can provide your business with innovative solutions for a wide range of operational challenges. From easier financial transactions to identity verification and data management, blockchains are a tool which businesses should consider and implement in their strategies to reach new heights.

Businesses can further benefit from blockchain through asset tokenization and decentralized applications (DApps). Asset tokenization enables the representation of physical and digital assets as tradable tokens, or NFTs, unlocking liquidity and enabling efficient transactions. DApps, built on blockchains, offer businesses decentralized, secure, and transparent solutions, from accessible supply chain management to automated smart contracts for various use cases. Even better, together, asset tokenization and DApps further empower businesses with enhanced liquidity, reduced operational complexities, and innovative avenues for growth, creating a position for your business which your competitors will hardly be able to reach and concur like you can.

Blockchains revolutionize accounting and reporting for businesses engaging in cryptocurrency transactions while ensuring compliance with local regulations. Blockchains can have integrated and automated accounting and reporting tools to help with the proper reporting of transactions. Additionally, adherence to jurisdictional regulations is embedded in smart contracts, allowing businesses to seamlessly navigate compliance requirements. By leveraging blockchain technology, businesses enhance the accuracy, efficiency, and regulatory compliance of their cryptocurrency accounting and reporting processes, paving the way for secure and transparent financial operations.

Blockchain payments have outdone their origins in cryptocurrencies, finding diverse use cases across industries. From finance to healthcare, this innovative technology is reshaping the way transactions are done. In finance, blockchain ensures secure and transparent transactions, while healthcare benefits from enhanced data integrity. Supply chains utilize blockchain for traceability and authenticity. Real estate transactions are streamlined with smart contracts. Entertainment sees blockchain powering transparent royalty distribution.

| Blockchain Payments | vs. | Centralized Payments |

|---|---|---|

| Decentralized = no central authority, every participant in the ledger has access | Controlled by a single organization (e.g. a bank, government) | |

| Rely on P2P transactions, removing intermediaries and reducing costs | Rely on intermediaries (banks, processors, verifiers) | |

| Due to their tamper-proof and decentralized nature, blockchains are trusted by users from all over the world as they also have secure consensus mechanisms | Trust between partners and clients can be hard to maintain as centralized payments rely on reputation and different security measures to maintain their promises | |

| Include crypto payments and often fiat currencies | Usually only work with fiat currencies (USD, EUR) | |

| Can open many doors for businesses to profit from the Web3 world, which is the future | Not part of any innovative technology that can boost a business’ success through their usage |

The reasons why businesses prefer blockchain payments to traditional centralized payments are many. It goes without saying that payments through blockchains are a part of a trusted decentralized system, which in itself is part of the Web3 movement. A business wanting to future-proof itself and to aim at innovation should consider joining in. Let the following successful use cases show you why that is exactly and how you can properly implement blockchain technology in your business for good.

Since 2014, Microsoft users have been able to pay with Bitcoins, but for certain services. Microsoft worked with BitPay to come up with a cryptocurrency solution to their payment options. BitPay is a bitcoin payment service provider founded in 2011 and still in collaboration with Microsoft. The option enabled Microsoft users to add money to their Microsoft accounts. Then, these funds were usable on purchases like apps, games and other digital content for Windows, Windows Phone, Xbox Games / Music / Video and Xbox Live services.

Nowadays, BitPay is even more accessible as it provides the service users with a digital debit card which can directly be used in any store. Bitcoin is no longer the only cryptocurrency available on the platform and is accompanied by ETH, DOGE, SHIB and many more. They also have an online portal where users can directly buy gift cards, like the Xbox Gift Card, which can then be used directly on the Xbox online store for games or other services. This development enables more people to invest in cryptocurrencies. For many, simple crypto investments aren’t enough, and they seek the ability to spend digital currencies on things they love.

n October 2020, PayPal announced its venture into the cryptocurrency space, allowing users to buy, sell, and hold various cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Bitcoin Cash, directly within their PayPal wallets.

By March 2021, PayPal expanded these services to allow users to use their cryptocurrency holdings to pay at millions of merchants that accept PayPal as a payment method. This move enabled users to seamlessly convert their cryptocurrencies into fiat currencies at the point of sale, facilitating practical and widespread use of cryptocurrencies for PayPal users.

The shift to digital forms of currencies is inevitable, bringing with it clear advantages in terms of financial inclusion and access; efficiency, speed and resilience of the payments system; and the ability for governments to disburse funds to citizens quickly

– PayPal CEO Dan Schulman

Users can easily access these features through their PayPal accounts, where they have the option to manage both traditional fiat currencies and cryptocurrencies in a merged interface. The integrated cryptocurrency payments not only provide users with investment opportunities but also offer a versatile method for utilizing digital assets in everyday transactions, bridging the gap between traditional finance and the evolving landscape of digital currencies. The option has been developed to enable users to use their cryptocurrencies with thousands of merchants worldwide.

Formula 1 has been actively exploring the world of NFTs (Non-Fungible Tokens) to revolutionize fan engagement and create innovative revenue streams. In 2019, F1 announced a partnership with Animoca Brands to develop and sell NFTs in a revolutionary way, through the F1 Delta Time project, which ran until 2022, when the game lost its license. F1 Delta Time was a blockchain-based game that revolved around the popular Formula 1 racing franchise. It utilized blockchain technology and non-fungible tokens (NFTs) to introduce a unique gaming and collectibles experience.

The game leveraged NFTs to represent digital assets, allowing players to own, buy, and sell unique and officially licensed Formula 1 digital collectibles. These collectibles included cars, drivers, car parts, and other in-game assets. F1 Delta Time incorporated a racing component where players could use their NFT cars to participate in virtual races. The performance of the cars was influenced by their attributes and specifications, creating a competitive and strategic element.

Some NFTs in the game were released as limited editions, and their rarity could affect their value and desirability within the game’s ecosystem, providing fans with an incentive to compete stronger for better assets. The blockchain-based game had its own virtual economy where players could trade, buy, and sell their NFTs using cryptocurrency. The ownership and transactions of these digital assets were recorded on the blockchain, ensuring transparency and authenticity, but foremost trust within both F1 and the users. F1 and Animoca Brands, whilst the game was up and running of course, were able to benefit from an additional revenue stream through these NFTs and engage with fans on an innovative level.

Tesla announced its acceptance of Bitcoin as a form of payment for its electric cars in March 2021. Elon Musk, Tesla’s CEO, made this groundbreaking announcement through Twitter, stating that customers in the United States could purchase Tesla vehicles using Bitcoin.

The move was seen as a significant step in the mainstream adoption of cryptocurrencies, as Tesla is a major player in the automotive industry. However, the decision also stirred discussions around the environmental impact of Bitcoin mining, as Musk later expressed concerns about the energy consumption associated with Bitcoin. While the option to buy Tesla cars with Bitcoin was briefly available Tesla suspended this payment method in May 2021, citing environmental concerns related to the energy usage of Bitcoin mining.

This use case is a great example of what sparked blockchains and the organizations behind them to become more environmentally friendly, and what will ultimately enable more businesses to provide cryptocurrency payments, possibly leading to Tesla accepting Bitcoin again. There are already several blockchains actively striving to be more environmentally friendly by adopting energy-efficient mechanisms. For example, Ethereum 2.0 has changed their PoW verification method to PoS, with the idea to reduce energy consumption of transactions.

Taco Bell, known for its innovative marketing campaigns, launched an NFT campaign to engage with a younger, tech-savvy audience. In March 2021, Taco Bell released the NFTacoBells collection, consisting of five unique taco artworks, five NFT copies each, totaling 25 NFTs up for grabs. Each NFT was sold for the initial price of $1, and the collection was sold out within half an hour. The fun part, and where most businesses would mostly benefit from, comes with the resales of the NFTs.

Some pieces received high bids on the market, with one reaching as high as over $3,000. NFTacoBells generated great hype around the brand and their NFTs, but Taco Bell also profited from NFT royalties. Each resale of the NFTs would bring the company 0.01% of the sold price, which in best case scenario could end up being a great new revenue stream for Taco Bell. All profits from the campaign would go to the Taco Bell Live Más Scholarship Program which funds young people to pursue higher education, prepare for the workforce or to change their communities through their passions.

Your business can profit by receiving payments through blockchains, but there are several components which you should consider. For example, the choice of the right cryptocurrency, or which blockchain to use, are vital for your success, if you don’t even consider the option to accept all cryptocurrencies available as payment. There are, however, more important components to consider.

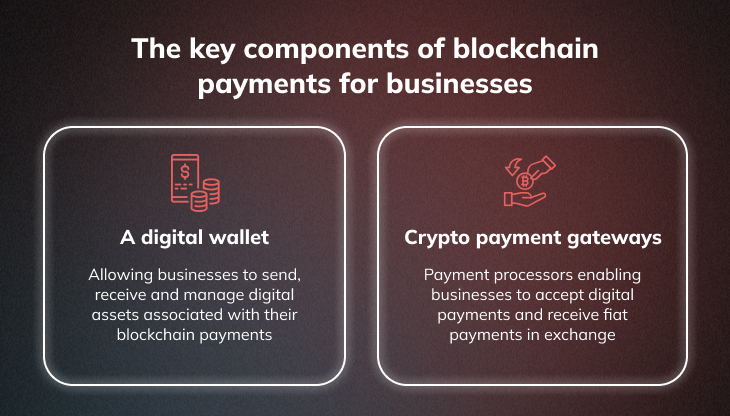

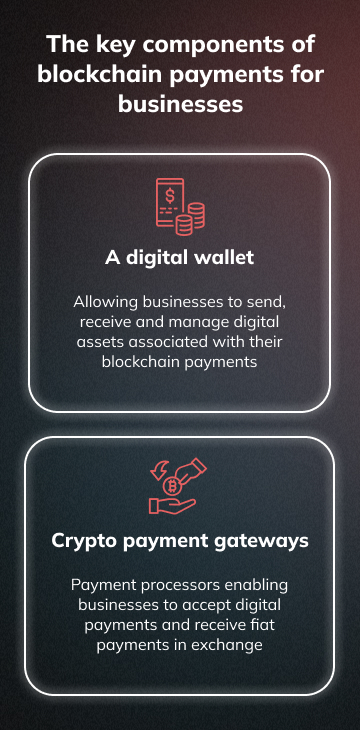

The two main components of payments accepted through blockchains for businesses are having the best digital crypto wallet there is and considering the right crypto payment gateways. Let’s explore what each of these important components is, and how to ensure that your business benefits the most from them.

Digital wallets play an important role in blockchain transactions, serving as secure storage spots for cryptographic keys. They enable users to store, send, and receive various cryptocurrencies. Hot wallets, those connected to the internet, are suitable for frequent transactions, while cold wallets, offline and more secure, for example in the form of USB devices, are ideal for long-term storage. Software wallets, like mobile or desktop applications, offer convenience, while hardware wallets, physical devices, prioritize enhanced security. By providing a user-friendly interface and safeguarding private keys, digital wallets empower individuals and businesses to seamlessly engage in the decentralized world of blockchain transactions. Examples of hardware crypto wallets include Ledger and Trezor and software wallets like Coinbase.

In blockchains, payment gateways serve as intermediaries that facilitate and manage transactions between parties, typically businesses and customers. These gateways ease the process of accepting cryptocurrency payments. Key functions include generating unique payment addresses, QR codes, or payment links for transactions. They also verify the authenticity and validity of transactions, ensuring security. Payment gateways act as a bridge between the blockchain and traditional financial systems, allowing businesses to accept cryptocurrency payments while providing a user-friendly interface for customers. Popular cryptocurrency payment gateways include BitPay and CoinGate each offering features that simplify the integration of blockchain payments for merchants.

Regulatory and compliance aspects of blockchain payments involve adherence to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. AML measures are implemented by financial institutions and other entities to detect and report suspicious transactions, verify the identity of customers, and ensure compliance with regulatory requirements. As part of AML requirements, KYC procedures are undertaken, which involve collecting and verifying customer information, including personal details and identification documents. Navigating these aspects is crucial for businesses engaged in blockchain payments to operate ethically, legally, and securely within the current global regulatory landscape. There are more global regulations and compliance challenges about blockchains, so it’s important to know these before venturing into blockchains.

Apart from AML and KYC regulations, other important global regulations include:

Knowing these important global regulations and ensuring that they are properly applied within your business and transactions can ensure that your business won’t have any issue going forward with payments based on the blockchain.

Blockchain technology faces several compliance challenges, primarily due to its decentralized and borderless nature. Some key challenges include:

Addressing these challenges requires engagement with regulators and a commitment to developing flexible solutions that align with evolving compliance standards, so businesses should be careful when tapping into the blockchain opportunity pool.

Blockchain payments encounter challenges primarily in scalability and energy consumption. The scalability issue arises from the decentralized nature of blockchains, causing transaction processing times to increase as the network grows. More users = longer transaction times. Popular blockchains like Bitcoin and Ethereum face limitations in transaction throughput, impacting the efficiency of payment systems during periods of high demand.

Additionally, the energy consumption of blockchain networks, particularly those using the Proof of Work (PoW) verification method, like Bitcoin, has raised environmental concerns. The extensive computational power required for PoW produces high energy consumption, contributing to carbon footprints. This environmental impact is a consideration for businesses aiming to adopt blockchain payments while prioritizing sustainability goals. The good news is, many blockchains are looking to become green blockchains, by lowering their carbon footprint. Additionally, many companies seek the transition to the PoS verification method, as it requires less energy consumption.

All in all, as technology evolves, businesses should stay informed about developments in blockchain scalability and energy-efficient solutions to make informed decisions about integrating blockchain payments into their operations.

Future trends in blockchain payments involve significant advancements like the progression of the current attempts to shift towards energy-efficient consensus mechanisms. Innovations in comparability will enhance transactions across various blockchains, fostering a more interconnected financial landscape, probably like an interconnected ecosystem. Industries such as supply chain management, healthcare, and finance, which already have great use cases, are very likely to leverage blockchain payments through enhanced transparency, security, and efficiency.

Smart contracts and decentralized finance (DeFi) applications will likely play a pivotal role, transforming traditional financial processes. As blockchain matures, businesses can anticipate a dynamic landscape with evolving technologies and diversified applications for blockchain payments, so keeping an open mind and looking out for opportunities will only benefit your business.

Embracing payments through blockchains is pivotal for businesses seeking success. Enhanced security, transparency, and efficiency redefine financial transactions. By harnessing blockchain’s potential, businesses forge a path to innovation, cost-effectiveness, and an outstanding position amongst competitors.

Hopefully, this ultimate blockchain payments guide for 2023 has shown you how to implement this information and to turn it to your benefit. Improving your business and harnessing success and great revenue streams is possible through blockchains, but if you’re not sure where to begin, then the experts at DigitalArtists.com invite you to get in touch. By having your best in mind, solutions to any of your issues and answers to all your questions, DigitalArtists.com can create a future-proofed and plan for your business’ best future.

Explore our FAQ section for comprehensive insights into blockchain payments. Clarify the most frequently asked questions on the topic for yourself and gain a deeper understanding of integrating this transformative technology into your business strategy.

Blockchain revolutionizes payments by introducing decentralized, transparent, and secure transactions. Through smart contracts, automated and trustless agreements streamline processes, reducing the need for intermediaries. Immutable ledgers ensure an indelible record, mitigating fraud risks. Cryptographic techniques protect user identities. With decentralized networks, there’s no single point of failure, enhancing resilience. Blockchain’s decentralized structure enables seamless cross-border transactions, eliminating delays associated with traditional banking. Reduced fees and faster settlement times make transactions efficient. In summary, blockchain transforms payments by prioritizing security, efficiency, and transparency, fundamentally reshaping the financial landscape for businesses and individuals alike.

Blockchain payments operate through a decentralized network of computers (nodes). Initiated transactions are verified by nodes for accuracy and adherence to the blockchain’s rules, and then grouped into a secure block linked to the previous one. This block, once validated through Proof of Work (PoW) or Proof of Stake (PoS) verification method, is permanently added to the blockchain. The digital ledger and digital wallets of the parties involved are updated, confirming the completed transaction.

Businesses accepting crypto payments need a digital wallet to securely store received cryptocurrencies. Additionally, integrating a reputable crypto payment gateway, such as BitPay or CoinGate, into their website or point-of-sale system is crucial. This gateway facilitates smooth transactions, providing customers with clear payment instructions. Tough cybersecurity measures are essential to protect both the business and its customers, but these come with any official and trusted blockchain nowadays.